22. desember 2020

Nbims aksjeplukkingsvirksomhet taper to milliarder kroner per år. Offentligheten, politikere og Finansdepartementet bør reagere.

22. desember 2020

Nbims aksjeplukkingsvirksomhet taper to milliarder kroner per år. Offentligheten, politikere og Finansdepartementet bør reagere.

16. desember 2020

Vi trenger en åpen, opplyst og ærlig

diskusjon om Oljefondets prestasjoner.

Men da kan vi ikke se bort fra

kostnader og risiko, slik oljefondssjefen

gjør.

(Foto: Fartein Rudjord)

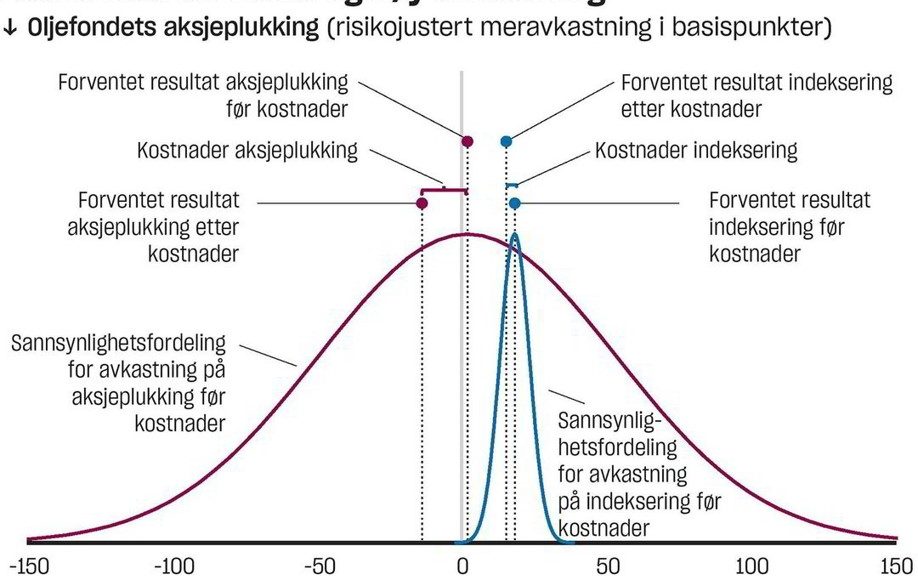

We show that with updated data covering the period 2013-2019, the risk adjusted return before costs from the stock picking-activity in the Government Pension Fund Global (GPFG) is zero for all practical purposes, and thus not significantly different from zero. The costs of managing this part of the portfolio appears to amount to about 20 bp per annum. After costs the return is thus negative

For explanation on methodology and factors, please see previous editions of this exercise.

Sources:

Underlying data:

201215_data

9. desember 2020

Det er en misforståelse at bobler eksisterer

i kapitalmarkedet og at aktive

forvaltere styrer klar av dem.

11. juni 2020

Det er to, og kun to, tiltak som kan gjøres mellom Nicolai Tangen og Nbim som tilfredsstiller det som bør være det norske folks krav om åpenhet, etterprøvbarhet og etisk forsvarlighet.

(Foto: Gorm K. Gaare)

https://www.dn.no/innlegg/nbim/nicolai-tangen/oljefondet/innlegg-det-handler-om-mulighet/2-1-861989

https://www.dn.no/innlegg/nbim/ako-capital/kapitalforvaltning/innlegg-kort-filosofi/2-1-866510

20. mai 2020

Det finnes en løsning som muliggjør både bedre avkastning på Oljefondet og Nicolai Tangens tiltredelse uten mistanke om samrøre.

6. mai 2020

Det har formodningen mot seg at det er et godt valg å sette en spekulant til å styre en «passiv», indeksforvaltet portefølje.

28. august 2019

Aksjeplukkingen i Norges Bank er fortsatt tapsbringende etter kostnader. Et nytt styre bør avvikle virksomheten.

28 August 2019

We show that with updated data covering the period 2013-2018, the risk adjusted return before costs from the stock picking-activity in the Government Pension Fund Global (GPFG) is negative, and not significantly different from zero. The costs of managing this part of the portfolio appears to amount to about 20 bp per annum. After costs the return is thus negative.